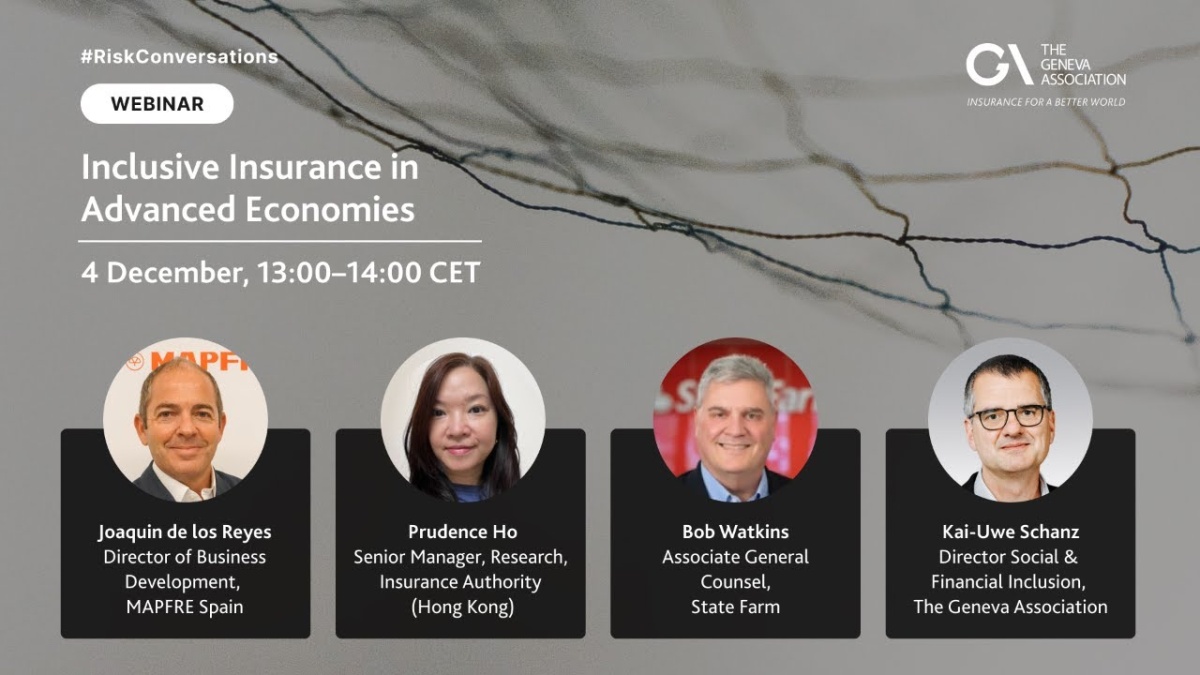

The erosion of social safety nets is creating inclusion gaps, where certain segments of society are inadequately protected against financial risk. Inclusive insurance targets those who are excluded from or underserved by traditional insurance – such as low-income earners, Gen Z and migrants – by offering affordable products that are tailored to their needs. The need for such initiatives is growing in mature markets.

A new Geneva Association report explores inclusion gaps for six demographic groups – the elderly, Gen Z, self-employed workers, low-income earners, migrants and the chronically ill – in seven advanced economies.