Critical Illness—Fit for the Elderly?

Health & Ageing Newsletter 31: Tim Eppert offers an analysis of how critical illness insurance can be an adequate insurance product to fit the needs of an ageing population faced with the risk of being diagnosed with a severe disease.

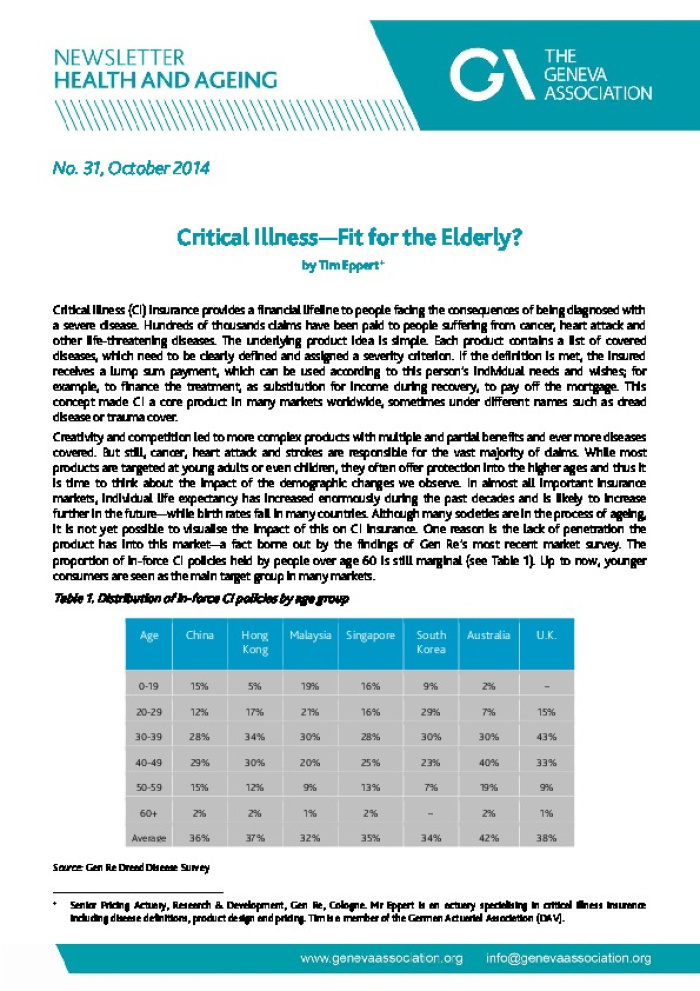

No. 31, October 2014 Critical Illness ?Fit for the Elderly? by Tim Eppert+ Critical illness (CI) insurance provides a financial lifeline to people facing the consequences of being diagnosed with a severe disease. Hundreds of thousands claims have been paid to people suffering from cancer, heart attack and other life -threatening d iseases. The underlying product idea is simple. Each product contains a list of covered diseases, which need to be clearly defined and assigned a severity criterion. If the definition is met, the insured receives a lump sum payment, which can be used according to this person?s individual needs and wishes; for example, to finance the treatment, as substitution for income during recovery, to pay off the mortgage. This concept made CI a core product in many markets worldwide, sometimes under different names su ch as dread disease or trauma cover. Creativity and competition led to more complex products with multiple and partial benefits and ever more diseases covered. But still, cancer, heart attack and strokes are responsible for the vast majority of claims. While most products are targeted at young adults or even children, they often offer protection into the higher ages and thus it is time to think about the impact of the demographic changes we observe. In almost all important insurance markets, individual lif e expectancy has increased enormously during the past decades and is likely to increase further in the future ?while birth rates fall in many countries. Although many societies are in the process of ageing, it is not yet possible to visualise the impact of this on CI insurance. One reason is the lack of penetration the product has into this market ?a fact borne out by the findings of Gen Re?s most recent market survey. The proportion of in- force CI policies held by people over age 60 is still marginal (see Table 1). Up to now, younger consumers are seen as the main target group in many markets. Table 1. Distribution of in-force CI policies by age group Source: Gen Re Dread Disease Survey + Senior Pricing Actuary, Research & Development , Gen Re, Cologne. Mr Eppert i s an actuary specialising in critical illness insurance including disease definitions, product design and pricing. Tim is a member of the Germ an Actuarial Association (DAV). Age China Hong Kong Malaysia Singapore South Korea Australia U.K. 0-19 15% 5% 19% 16% 9% 2% ? 20-29 12% 17% 21% 16% 29% 7% 15% 30-39 28% 34% 30% 28% 30% 30% 43% 40-49 29% 30% 20% 25% 23% 40% 33% 50-59 15% 12% 9% 13% 7% 19% 9% 60+ 2% 2% 1% 2% ? 2% 1% Average 36% 37% 32% 35% 34% 42% 38%