How insurers can use new approaches to tackle climate change risk

The impact of climate change is becoming increasingly evident. In the last year alone, we have witnessed devastating floods in Pakistan, wildfires in Australia, Europe and North America, and droughts across the world.

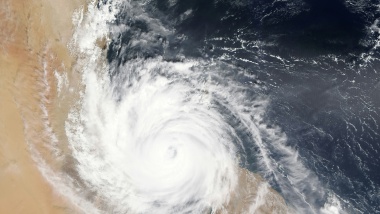

For insurers, climate change is altering the future likelihood of a wide range of risks. The frequency, severity, and location of extreme weather events like hurricanes and floods are changing. Transition risks are also arising from the shift towards a lower-carbon economy, while the landscape of climate litigation risk is evolving fast, with the number of climate-related lawsuits set to continue growing in the years ahead.

This ever-changing landscape has significant implications for insurers and reinsurers trying to assess the risks and opportunities that climate change presents for their business model. The recent report from the Geneva Association Task Force on Climate Change Risk Assessment, Anchoring Climate Change Risk Assessment in Core Business Decisions in Insurance, is focused on addressing that evolving landscape and how insurers can best respond to it.

It offers re/insurers a framework and tools which can allow for a more holistic approach to climate change risk assessment. In short, that approach should consider physical, transition and litigation risks, both in the long and short term. Crucially, it should consider both climate change’s impact on their business model, and their business model’s impact on climate change.

Beyond benchmark scenarios

The need for a holistic approach to climate change risk assessment is underlined by the fact that current measures are limited. Several organisations, including the Intergovernmental Panel on Climate Change and the Network for Greening Financial System, have produced benchmark climate change scenarios, providing more clarity on the potential impacts of global warming of 1.5°C and other levels, which are among the most heavily used in the financial sector. These scenarios use different assumptions based on socio-economic factors, public policy and emission targets, to map potential climate change outcomes. However, these sets of scenarios are not, on their own, sufficient to study the climate-related risks of a specific insurance company. While they can provide a useful narrative for a re/insurer’s own risk assessment, companies need to adopt a more flexible and wider-ranging approach to arrive at useful results.

Outside-in, inside-out

Re/insurance firms around the world are currently at different stages of assessing climate risk. They are increasingly doing so by adopting two complementary approaches.

On one hand, companies are increasingly analysing the resilience of their business models to climate change – a process known as outside-in analysis. This approach uses quantitative models and qualitative approaches like stakeholder surveys to model how climate change may affect their liabilities and assets.

In parallel, companies are assessing the impact of their own actions on the climate – inside-out analysis. This might include considerations such as how carbon-intensive a company’s investment portfolio is, or the extent to which its underwriting supports industries with different carbon intensity.

The fact that companies are adopting both approaches to assessing climate change risk is a welcome development. A key finding from our report, however, is that both of these approaches need to be aligned. Setting climate targets using inside-out approaches needs to be aligned with outside-in analysis. In fact, growing groups of critics are already calling out firms in the financial sector for the misalignment between their net-zero commitments and their already committed investments in carbon-intensive sectors for years to come. This could lead to potential climate litigation risk.

Starting simple and building complexity over time

So, how can companies create an aligned, holistic approach to assessing climate change risk? The key is starting simple. That means investigating the impacts of each climate change risk type – physical, transition and litigation – and considering two timeframes: the short term and the long term. As a company’s capacity to assess climate change risk increases, these analyses can become increasingly complex. Crucially, this approach starts at the top. Company boards and executives need to consider key issues to drive their climate change risk assessment towards a more holistic approach, including board oversight, setting a company-wide mandate on climate change, and the creation of ’business use cases’ designed to guide different iterations of a company’s climate change risk assessment.

It is clear that there are still many limitations with data, tools and evolving science, which means climate change risk assessment carries many uncertainties. That is why it is vital for companies to be able to assess the resilience of their business models with a holistic approach, ensuring their actions on climate risk are aligned company-wide. Doing so will allow re/insurers to innovate and offer risk management and investment solutions that support the global transition to a resilient, carbon-neutral economy in the future.