Boston, U.S., kindly hosted by the Liberty Mutual Climate Transition Center

On the Frontline of Climate Change: The essential role of insurance

This conference explored how to enhance the insurability of physical climate risk and address the massive financing gap for building climate resilience and decarbonising the economy. It explored how insurers, as risk managers and investors, can enable and innovate solutions, including through cross-sectoral collaboration, to help build societal resilience and expedite the transition.

Opening remarks: Maryam Golnaraghi

Maryam Golnaraghi, Director Climate Change & Environment, The Geneva Association

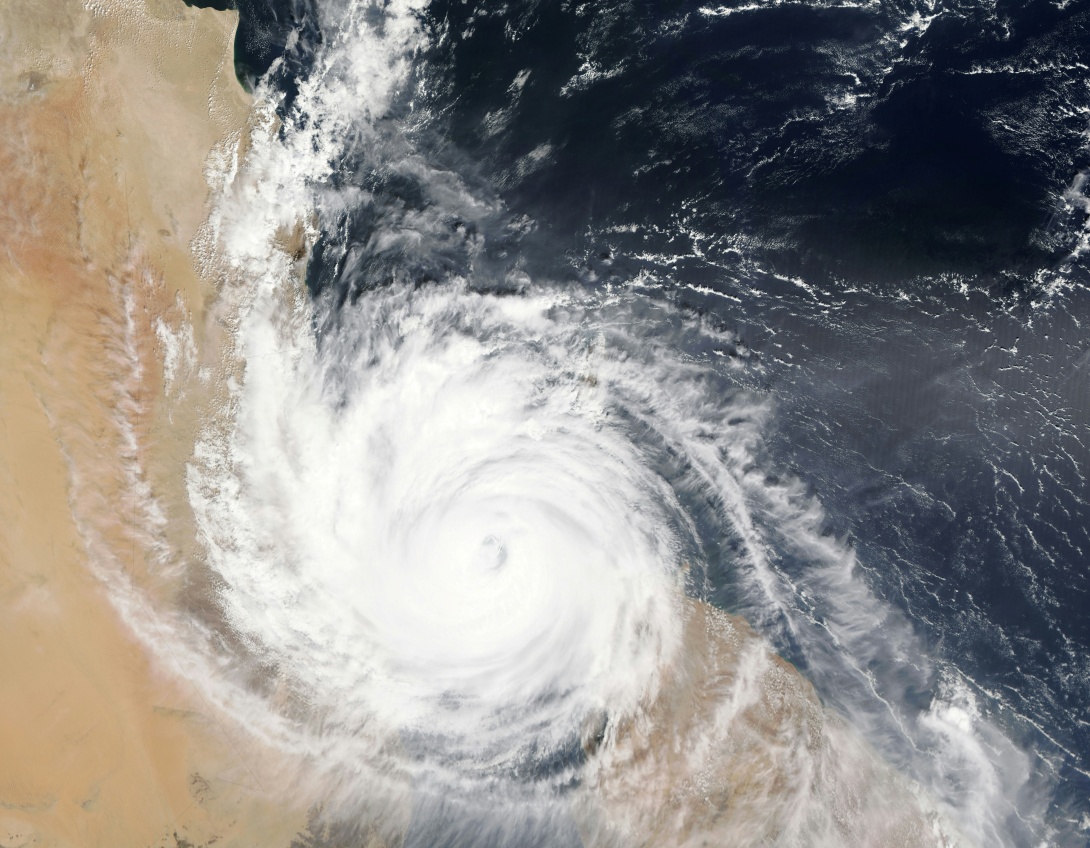

Climate change is altering the frequency, severity and geographic occurrences of extreme weather events and is also leading to sea-level rise and water scarcity. The impacts are exacerbated by where and how we have built, as well as ageing infrastructure.

Over the last three decades, global insured losses from weather-related extreme events have more than quintupled, yet these only account for about a third of total economic losses. Many factors are limiting insurance uptake, and the availability and affordability of re/insurance is a rising concern. The importance of investing in risk management is also coming into focus.

The cost of climate adaptation could become prohibitive in some regions if climate mitigation measures are not scaled. This requires massive transformation across all sectors of the economy, shifts in market and consumer behaviours and the deployment of new technologies over the coming decades. This will necessitate substantial reallocations of capital.

A number of developments are paving the way, such as transformative public policy, government subsidies, industry and government alliances, and coordinated investment platforms. Insurers can contribute through their risk management expertise and their investments.

Keynote interview: Tim Sweeney

Jad Ariss, Managing Director, The Geneva Association; Tim Sweeney, President & CEO, Liberty Mutual Insurance

Climate change is a complex, multi-faceted challenge affecting people, communities, and economies worldwide. Tackling the problem requires engagement and cross-sector collaboration, as no single group or sector has all the answers. While the focus has historically been on mitigation, there is growing recognition of the importance of climate resiliency. However, scaled investments in adaptation remain insufficient.

Insurers and reinsurers help individuals, businesses, and governments manage escalating risks from climate change through three primary functions:

- Helping residential and commercial sectors adapt to climate impacts and adopt mitigation solutions.

- Assisting customers in their own journeys to lower carbon.

- Leveraging the asset side of their balance sheets to expedite investments in resilience and decarbonisation.

To maximise its impact, the insurance industry must better communicate its role and educate stakeholders on risks, mitigation strategies, and relevant products. Key focus areas include:

- Collaborating at the local level – with mayors, communities, and homeowners – since physical risk is localised.

- De-risking the energy transition by framing and managing risks related to new technologies from the outset.

- Sharing research and risk information with policymakers and other sectors to develop innovative, scalable solutions.

- Helping retail and commercial customers plan for an uncertain future by focusing on education, tailored solutions, and proactive guidance.

- Prioritising workforce development to ensure a shared understanding of climate-related challenges and opportunities across their organisations.

As climate change accelerates, the demand for scalable, agile insurance solutions will grow. Insurers are uniquely positioned to educate, guide and protect their customers while driving the transition to a resilient and sustainable future. By prioritising collaboration, innovation, and customer-focused solutions, the insurance industry can play a transformative role in addressing the challenges of climate change.

Boosting the Insurability of Physical Climate Risk: An all-of-society endeavour

Dave Burt, Founder & CEO, DeltaTerra Capital; Carla Smith, EVP & Chief People, Strategy & Climate Officer, Intact Financial Corporation; Roy E. Wright, President & CEO, Insurance Institute for Business & Home Safety; Kevin Gaffney, Commissioner, Vermont Department of Financial Regulation; Ernst Rauch, Chief Climate & Geo Scientist

Without appropriate risk-reduction and prevention measures, the availability and affordability of insurance may be impacted. As already seen in some U.S. states, regulatory discussions have shifted from questioning whether insurance can remain affordable to whether it can remain available at all.

Risk-based pricing is essential for accurately reflecting increasing climate risks. However, while regulators are concerned about the solvency of insurance companies, they must also consider consumer protection. With many homes in high-risk regions lacking access to insurance, collaboration between policymakers and insurers, e.g. through public-private partnerships, is critical. Clearer explanations to consumers as to why insurance costs are rising are also needed.

Insurers are investing significantly in collaborative research to develop risk-reduction guidelines for homeowners and communities.

Innovation in product offerings and educating consumers, communities and governments will be critical for insurers. From an investment perspective, the accurate risk pricing of assets is essential to mortgage and real estate markets.

Special address: Tom Rowlands-Rees

Tom Rowlands-Rees, Head of Research, North America, BloombergNEF

The most effective way to significantly decrease global emissions is a dual approach which balances investment in mature and emerging technologies.

Investments in clean energy have significantly increased worldwide, reaching record levels in 2023. Wind and solar energy as well as electric vehicles have driven much of this progress, with production costs falling and adoption becoming more widespread.

However, while data shows that emissions have fallen, for example in the U.S., the bulk of this has come from replacing coal with natural gas. While this may be effective in the short term, longer-term solutions must focus on accelerating the transition away from fossil fuels to new sources of energy to develop a reliable mix of energy sources.

Investments must target emerging technologies such as bioenergy, hydrogen, geothermal and carbon-capture utilisation and storage. These emerging technologies represent high-value opportunities, particularly in hard-to-abate sectors, but require accelerated development to meet global climate goals. A successful strategy thus hinges on capitalising on the momentum of mature clean technologies, while expediting the deployment of emerging ones.

Panel 2: Changing the Financing Narrative: How can insurance enable the energy transition?

John C. S. Anderson, Global Head Corporate Finance & Infrastructure, Manulife; Liz Geary, President, Insurance Solutions, Liberty Mutual Insurance; Sonja Gibbs, Managing Director & Head of Sustainable Finance, Institute of International Finance; Tom Rowlands-Rees, Head of Research North America, BloombergNEF; Maryam Golnaraghi, Director Climate Change & Environment, The Geneva Association

The focus of finance on the energy transition may have diverted attention from the role other critical economic sectors must play. While progress is being made to develop emerging climate technologies, they need to be scaled significantly in order to achieve global climate goals. The insurance industry can play a pivotal role through its risk-engineering expertise – framing risks, working with other stakeholders to develop risk management solutions, and developing innovative insurance solutions.

Data collection and sharing are increasingly important for accurate risk assessment and insurance pricing. Government policies, public-private partnerships and strategic collaborations (for example, insurer-venture capitalist partnerships) are also needed for a scalable and affordable transition.

As institutional investors, insurers can play a strategic role in the commercial deployment stages of climate technologies. Efforts to reduce the risk premiums of emerging technologies will help enhance risk-adjusted returns and attract investors.

Keynote speech: Vanessa Z. Chan

Vanessa Z. Chan, Chief Commercialization Officer & Director, Office of Technology, U.S. Department of Energy

While government initiatives have resulted in sizeable progress in accelerating the commercialisation of clean energy technologies, significant challenges remain, particularly with scaling.

The U.S. Department of Energy has been at the forefront of this, leveraging huge investments to ensure scalable technological advancements. However, despite bold federal investments, such as the USD 8 billion allocated to hydrogen hubs, significant private-sector engagement is still required to close the financing gap and drive the deployment of clean technologies.

Overcoming barriers, from limited supply chains to high development costs, will require innovative public-private sector collaboration, where the private sector takes the lead and governments provide support. New frameworks, like the Adoption Readiness Level (ARL) framework, will help industries to better understand, assess and manage the risks associated with efficiently scaling up new technologies.

By de-risking these new technologies, insurers can enable investors to overcome the risks associated with financing ‘first-of-a-kind’ pilots and fund these technologies without substantial capital losses.

Panel 3: The Household Transition: How consumer behaviour can move the needle on climate change

Jeff McAulay, CEO & Co-Founder, Energetic Capital; Eric Johnson, Norman Eig Professor of Business & Director, Center for the Decision Sciences, Columbia Business School; Greg Guthridge, Global Customer Transformation Lead, Energy & Resources Consulting, Ernst & Young; Rakhi Kumar, SVP, Business Integration & Sustainability Solutions, Liberty Mutual Insurance

The household transition is a critical component of achieving broader climate objectives by significantly reducing emissions. This will require a fundamental shift in consumer behaviour and decision-making.

While many consumers recognise the need to address climate change, there is confusion about the most impactful measures they can take. Recent efforts have underlined the need for policies that directly address consumer engagement beyond traditional supply-side interventions. Simplified digital integration of energy solutions and default programmes are emerging as key strategies aimed at reducing friction in consumer decision-making.

The energy transition depends on the ability to activate a broader segment of consumers, especially as early adopters have already acted. Simplifying information and choices presented to consumers may lead to broader adoption of green solutions and technologies at the household level. Comprehensive public policies, coupled with private-sector initiatives, must focus on making sustainable actions more straightforward for households.

Interactive session 1: Forward-looking Climate Risk Information for Enhanced Decision-making

William Keithler, Senior Director, Chief Investment Office, AIG; Raghuveer Vinukollu, Head, Climate Insights & Advisory, Munich Re US

This session examined the need for climate risk information to support decision making in the insurance industry, as well as how to vet the next generation of climate risk analytics tools.

A shift is underway in the use of model outputs. Forward-looking climate risk modelling should be stochastic, offering a range of scenarios

Explaining the changes to these models and the assumptions they make is hard, particularly when their outputs result in a financial statement adjustment. Decision makers need to be educated to interpret the results properly.

Collaboration across the industry promotes learning and the advancement of the next generation of risk models. Larger companies can invest in their own models, while smaller firms use third-party software.

Models will be used differently on the liability and asset sides, but the data needs are similar and assumptions should be consistent. Models should also allow users to customise their assumptions, which allows for mid-cycle updates.

Data availability and standardisation, particularly when it comes to property, e.g. when a home was built or the location of critical infrastructure, is essential.

Public access to risk information could lead to a significant and widespread repricing of property insurance and generate a decline in the value of real-estate assets in insurers’ investment portfolios.

Interactive session 2: How the Climate Transition will Impact the Insurance Business Model

Margaret Peloso, Global Climate Officer & Executive Director, Chubb Charitable Foundation

This session explored the ways in which current insurance business models may need to change in light of the transition to a more climate-resilient and decarbonised economy. Solutions to address the emerging needs of individuals, businesses and governments were also discussed.

Key themes included rethinking how insurers manage and share risk, such as pooled risk-sharing among different industry players. There were calls to align success metrics with sustainability, engage earlier in projects for proactive risk mitigation, and incentivise sustainable behaviours among customers. The need for risk underwriting teams and investment teams to work together rather than in silos was also underscored, given both have a role to play in incentivising the transition of insureds / investees.

The need for blended public-private financing models and enhanced collaboration with governments, regulators and other industries was emphasised. At the same time, the role of public sector entities needs to be adjusted, with focus on educating local communities to be more resilient to climate change

A reset in expectations is necessary, and the traditional ‘risk transfer’ role of insurers should evolve to include risk reduction.

Interactive session 3: How Can the Insurance Industry Champion Resiliency?

Swenja Surminski, Professor in Practice, LSE and Climate Thought Leader, Marsh McLennan

A ‘carrot-and-stick’ approach is required to increase climate resiliency in response to increasing physical climate risks. Incentives to take action and rules to avoid unnecessary risk creation are equally important. But both require a much-needed increase in risk-and-resilience education to galvanise action ahead of disasters to protect property values, assets and, most importantly, lives.

Resilience efforts at the homeowner level are often insufficient due to a lack of information, misconception of risk, or limited or inaccessible funds. Most homeowners don’t understand that they will be responsible for a higher level of risk, given the changing climate, and that they will need to take proactive resiliency measures. Risk information deficits also persist within local government, businesses and banks, and insurers’ understanding of resilience dynamics is also often limited.

With this in mind, the insurance industry could support the education of consumers at the point of sale on the upfront versus long-term costs of resiliency improvements. Builders and developers should also be educated to see the value of incorporating increased resiliency measures into projects, possibly through resiliency ratings of buildings. Common understanding of what resiliency measures need to happen at the asset level (homeowner) and the community level (local municipality), and how they are interconnected, is also essential. For example, insurance staff could engage in local resilience forums and support awareness raising. Finally, industry understanding of the renter versus landlord dynamic and who should be asking for/making changes is important.