Virtual conference

Environmental Risks and the Insurance Industry: Stepping up actions

There is growing evidence of the large-scale impacts of human behaviours on the environment, with serious knock-on effects for society. Important actions are underway: sustainable finance initiatives, the Task Force on Nature-related Financial Disclosures (TNFD), and for re/insurers, overall greater emphasis on Environmental, Social and Governance (ESG) approaches to investing and underwriting.

The Geneva Association’s Climate Change & Environment Conference, held virtually on 23 June 2021 and co-organised with Swiss Re, explored the many implications of environmental risks for re/insurers.

Summary

Welcome address

Christian Mumenthaler, CEO of Swiss Re, gave the welcome address.

Though the insurance industry has made significant progress on initiatives to tackle climate change and the risks it entails, addressing the environmental risks posed by biodiversity loss and the destruction of nature-based systems presents a more daunting challenge. The socio-economic impacts of these risks are profound – according to the Swiss Re Institute, 50% of the world’s GDP is dependent on such ecosystem services – and insurers have an important role to play in combating them. More accurate quantification of the value of nature-based systems will be essential, as will the development of innovative, scalable insurance products and services to help protect them.

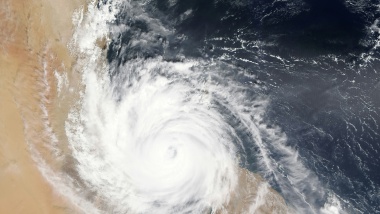

Insurance products and services can also help protect nature, such as Swiss Re’s parametric insurance for the protection of coral reefs in Mexico. There is evidence that healthy coral reefs reduce the impacts of hurricanes – of particular importance in coastal areas and tourisms centres. Although this initiative is not yet scalable, the industry could use it as a basis for driving innovation.

Panel 1: Executive Insights: Environmental risks as a core business issue for insurers

(Top) Scott Hart, CIO, Manulife Financial; Maryam Golnaraghi, Director Climate Change & Environment; Patrick Raaflaub, Group CRO, Swiss Re. (Bottom) Matt Saker, Group Chief Actuary, Aviva; Roland Umbricht, Head of Global P&C, Allianz.

The first panel focused on how climate change and nature-based risks are becoming a core business issue for insurers on both sides of the balance sheet.

Key messages:

- Climate change and environmental & nature-based risks are interconnected. Understanding this interconnectedness is key to realising diversification benefits and balancing portfolio risk. Insurers need to identify the materiality of these risks, as well as how to price and manage them.

- The launch of the TNFD will kick-start thinking about how to bring environmental and nature-based risks into the financial risk conversation.

- Environmental problems have the advantage of being more localised than climate change. There are opportunities to use traditional insurance tools for pricing risk, and ideas or concepts can be transferred from one location or community to another.

- To date, insurers have been tackling net zero via investments more than underwriting, but this is changing.

Implications for insurers:

- The industry can employ a carrot-or-stick approach to bring about change. For example, insurers could withdraw D&O cover for certain types of risks; alternatively, individuals and companies could be incentivised to change their behaviour through the provision of innovative and relevant products and services.

- The insurance industry will play an important role in de-risking the pathways for scaling up the implementation of negative emissions technologies. Investment in certain sectors, such as oil and gas, will need to be de-emphasised.

- Insurers will need to form partnerships and engage with governments, NGOs and customers to find effective solutions.

Keynote speech: The challenges of addressing climate change and nature

Sir Robert Watson, former chair of the Intergovernmental Panel on Climate Change (IPCC) and the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES).

In his keynote speech, Sir Robert Watson, former chair of the Intergovernmental Panel on Climate Change (IPCC) and the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES), outlined actions that need to be taken to tackle climate and environmental risks more effectively.

Greenhouse gas emissions must be drastically reduced between now and 2030 if we are to reach net zero by 2050. Insurers must start to decarbonise their portfolios now as part of a major shift away from investments in environmentally unsustainable activities and toward economic activities that enhance the stock of natural assets. All drivers of biodiversity loss must be addressed in order to conserve what is left and, where possible, restore what has already been lost. This will require changes in policies and regulation, and thus necessitates increased collaboration between governments, regulators and the private sector. Equally important will be addressing climate and environmental risks concomitantly with development challenges such as food and water security and universal healthcare.

Panel 2: Looking ahead: How can insurers address the drivers and impacts of environmental risks?

(Top) Martin Weymann, Head of Sustainability, Swiss Re; Claire O’Neill, Managing Director, Climate & Energy, WBCSD; Chip Cunliffe, Biodiversity Director, AXA XL. (Bottom) Marie Dirion, Managing Director, Moody’s Investor Service; Margaret Kuhlow, Finance Practice Leader, WWF; Michele Lacroix, Head of Group Investment Risk & Sustainability, SCOR.

The second panel discussion looked at how to measure the materiality of environmental risks and incentivise behavioural change.

Key messages:

- A central repository of corporate decarbonisation baselines or pledges is needed. Nationally determined contributions (NDCs) cannot be used in place of corporate footprints.

- Actions are needed to reduce GHG emissions, remove carbon from the atmosphere through carbon capture or storage, adapt to climate risks – through, for example, infrastructure improvements – and protect nature-based systems.

- The accounting and valuation of natural capital is fundamental to facilitating the transition away from carbon-heavy assets. The TNFD has an important role to play in supporting nature-positive decision making, by providing a framework for businesses to disclose and act on nature-based risks.

- Sectors that are most exposed to biodiversity and nature-based capital-related risks must be identified.

- The EU is developing a framework that enhances the use of insurance against climate-related risks and promotes insurance disaster schemes to encourage investment in adaptation.

Implications for insurers:

- Insurers need to go beyond simply considering the risks on their own balance sheets and think about the broader impacts they can have through their actions.

- Insurers should leverage innovation but also use existing tools such as ENCORE (Exploring Natural Capital Opportunities, Risks and Exposure), as well as engage with the TNFD, to examine their own nature-related risks. They will need a combination of quantitative and qualitative models to develop decision-useful risk information.

- Parametric products need to be better developed and scaled. Collaboration will be required between the insurance industry, governments and multilateral organisations.