Virtual event

Recovering from the Pandemic: The emerging risk and regulatory landscape

The Geneva Association’s Programme on Regulation and Supervision (PROGRES) is a platform for needed conversation between insurers, policymakers, regulators and supervisors on policy and regulatory objectives and challenges.

This virtual event, held on 25 March 2021, included two panel sessions, 'Foresight on environmental risks' and 'Balancing customer protection and prudential regulatory considerations during the pandemic', and concluded with a keynote from David Altmaier, President of the U.S. National Association of Insurance Commissioners (NAIC) and Vice-chair of the Executive Committee of the International Association of Insurance Supervisors (IAIS).

Summary

Session 1: Foresight on environmental risks

(Top) Ben Carr, Aviva, Sarah Chapman, Manulife Financial, Jeremy McDaniels, IIF (Middle) Petra Hielkema, DNB , Sylvain Vanston, AXA, Daniel Wang, Monetary Authority of Singapore & Sustainable Insurance Forum (Bottom) Maryam Golnaraghi, The Geneva Association

The first panel discussed regulatory approaches to climate and emerging environmental risks and what they mean for the insurance industry.

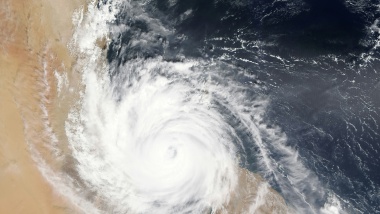

Climate change and environmental degradation, such as biodiversity loss, are a source of financial risk. Financial institutions, including insurers, need to appropriately address them in order to adopt future-oriented business models. Insurers also have an important role to play in helping customers become more resilient to climate and environmental risks.

Different regulatory initiatives underway are fragmented due to a lack of standard, internationally-valid technical terms for environmental risk reporting. Prudential authorities should therefore leverage market-led efforts on disclosure, encourage wider deployment of voluntary best practices towards comparability and ensure that disclosure requirements are harmonised.

Concerning prudential requirements to incentivise environmental risk management, drastic moves on capital requirements are unlikely in the near future, due to diverging views within the regulatory community and a lack of data.

Scenario analyses are an important tool in assessing financial system-wide risks emanating from climate and environmental risks, but these should not be used to inform prudential capital requirements. Insurers should act now and not wait for regulations and data sets to be in place.

Session 2: Balancing customer protection and prudential regulatory considerations during the pandemic

(Top) Matt Brewis, Financial Conduct Authority UK, Alberto Corinti, IVASS Italy, Kate Nicholls, UK Hospitality (Middle) Marc Sarbach, Swiss Mobiliar, Kai-Uwe Schanz, The Geneva Association, Claudia Strametz, Munich Re (Bottom) Dennis Noordhoek, The Geneva Association

The second panel session discussed the business interruption protection gap exposed by the COVID-19 pandemic.

Taking the U.K. as an example, many businesses assumed their business interruption insurance policy covered pandemics. Test cases brought to court by the FCA revealed ambiguous policy wordings in several cases. Some insurers have decided to retroactively cover pandemic-related business interruption, assessing that the long-term reputational damage for not paying out is more costly than paying claims in the short term. However, regulators are not urging insurers to pay claims out of policy. Hence there is no conflict between conduct and prudential regulation objectives.

On a global scale, the issue with ambiguous policy wordings is rather small and pandemics in most cases are clearly excluded. This raises the question as to why the role of insurers is limited when it comes to covering pandemic-related economic losses. The nature of a pandemic makes it impossible to insure economic losses resulting from government-mandated business closures, as most of the insurability criteria (such as independent and predictable loss exposures) are not met; insuring pandemic-related economic losses would put insurers’ balance sheets at risk.

The focus on BI policies has led to false perceptions that insurers are absent when it comes to providing pandemic cover. Pandemic-related insurance cover is in fact abundant in other business lines: life, health, event cancellation, and travel.

Although actuarial and economic analysis points to a very limited ability for insurers to take pandemic-related BI risks onto their balance sheets, insurers can play a role in government-led solutions, for example by providing their expertise or their infrastructure.

Keynote: National and International Collaboration: protecting consumers and promoting resilient insurance markets

David Altmaier, President, NAIC, and Vice-chair of the Executive Committee, IAIS

In his keynote speech, David Altmaier, President of the NAIC and Vice-Chair of the IAIS Executive Committee, expounded the priorities of the NAIC for 2021 and updated on the implementation of the International Capital Standard (ICS).

Besides COVID-19, the NAIC’s priorities for 2021 are 1) climate risk and resilience; 2) race and insurance; 3) big data and artificial intelligence; 4) consumer data privacy; and 5) long-term care insurance. In particular:

- In response to the COVID-19 crisis, the NAIC has been working with stakeholders on a federal mechanism to help ensure the widespread availability of business interruption insurance for pandemic risks.

- The NAIC’s Climate and Resiliency Task Force is currently evaluating regulatory approaches for innovative solutions that would offer consumers more protection. The NAIC’s Climate Risk Disclosure Survey, presently underway, should provide clarity on data-reporting requirements.

In terms of international developments, the IAIS is entering the second year of the five-year Monitoring Period of the ICS. Though the first year did not go as envisioned due to COVID-19, it was nevertheless informative, with gratitude to the insurance groups that participated in the annual data collection. The NAIC adopted its Group Capital Calculation (GCC) in November 2020 – a milestone for group capital calculation in the US. The GCC should provide useful insights to the IAIS in developing the Aggregation Method – which is considered better suited to the U.S. supervisory regime than the ICS.