Milan, Italy, kindly hosted by Generali

Generative AI and the Future of Insurance

In 2022, OpenAI released ChatGPT, bringing generative AI into the daily life and work of the masses. This new suite of tools has begun to transform the entire insurance value chain – from marketing and underwriting to customer engagement, claims experience and service delivery. The potential is immense. However, there is still much for insurers to figure out in order to drive the effective and safe adoption of this technology.

The Geneva Association’s 2024 Digital Technologies Conference focused on how AI and generative AI will impact the future of insurance. This summary gives an overview of the discussions.

Summary

Opening remarks

Andrea Sironi, Chairman, Generali

Suitable regulation is needed to address ethical considerations associated with the use of AI, including privacy concerns, bias and accountability. However, overregulation could stifle innovation. Insurance is one of the most heavily-regulated sectors and so it is at the forefront of AI regulation. Insurers are also particularly aware of the risks and benefits of these technologies. For example, AI could contribute to increased financial literacy but it is also energy intensive. Insurers should work to maintain a balance between innovation and governance to benefit both their customers and their own companies.

Keynote speech

Manuela Diviach, Head of Group Operations, Organization & Data, Allianz

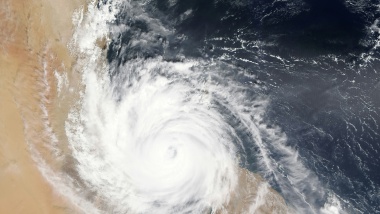

Global spending on AI is growing rapidly and is projected to reach USD 297 billion by 2027, a 19.1% increase from 2022. AI has the potential to close significant protection gaps in insurance, including in natural catastrophes, cyber and health. Good quality data, customer confidence in the technology and a human-in-the-loop approach are essential to ensuring responsible AI use. Building trust among employees, leading by example, and providing ample training and opportunities for upskilling are also needed to build a culture of innovation and confidence in AI within insurance companies.

Panel session: AI and Financial Inclusion in Insurance

Moderator: Adrien Lebègue, Managing Director, ZA Tech/ZhongAn Insurance

Speakers: Carl Bauer, General Partner, Eos Venture Partners; Alessandro Bonaita, Group AI Governance Program Director, Generali; Arianna Brina, InsurTech Expert on Consumer Protection, EIOPA; Bryan Pickel, Head of Global External Affairs and Sustainability, Prudential Financial

By facilitating the shift towards risk prediction and prevention and allowing the development of more personalised insurance products, AI has the potential to narrow protection gaps, in particular in health insurance. However, awareness is growing about the risks associated with the use of AI, and the adoption of AI in the insurance sector could be slower than expected. Realising the benefits of these technologies will require collaboration between insurers, regulators and other key stakeholders.

Keynote speech

Marcin Detyniecki, Group Chief Data Scientist & Head of AI Research, AXA

AI has evolved rapidly – from symbolic AI to machine learning and generative AI. The adoption of large language models in various applications is transforming core insurance processes. Technical concerns, such as issues related to intellectual property, hallucinations, and the need for systematic risk management when it comes to privacy, security, fairness, transparency and safety, need to be addressed. But successfully implemented, AI will drive efficiency, reduce costs and improve customer satisfaction.

Panel session: Market Practice and Use Cases of Generative AI in Insurance

Moderator: Daniele Scarpari, EMEIA Insurance Technology Leader, EY

Speakers: David Cis, Group Chief Operating Officer, Generali; Pranay Jain, CEO & Co-Founder, Enterprise Bot; Bruno Scaroni, CEO Zurich Italy, Zurich Insurance; Camila Serna, EVP, Global Head of Digital Acceleration, Chubb

This panel session explored approaches to adopting AI in insurance, including applications in underwriting, claims, marketing and product development. The session addressed the importance of internal regulation and the balance between in-house development and outsourcing. Potential risks associated with AI were also highlighted, including cyber risks, product liability and the impact of AI on customer interactions, emphasising the need for responsible use and flexibility in adapting to the evolving AI landscape.

Panel session: Technological Advancements in Risk Prevention, Prediction and Protection: What will insurance look like in 2035?

Moderator: Atsushi Izu, Head of London Innovation Lab, Dai-ichi Life

Speakers: Martha Boeckenfeld, Founder of the Marthaverse, Founder Femitopia; Emanuele Colonnella, Innovation Lead, Generali; Adam L’Italien, Chief Innovation Officer, Liberty Mutual; Jing XIAO, Group Chief Scientist, Ping An

The final session looked into the future, envisioning a society where AI plays a bigger role in the daily lives of insurance customers; for example, through technologies for warning systems for severe weather and for monitoring home electrical systems to prevent fires. However, as AI's influence grows, so do concerns about misinformation and fraud, necessitating additional regulations. Adaptability and experimentation will be key to navigating this evolving landscape, which will require insurers to embrace technology, sustainability and customer engagement.