Zurich, Switzerland

Dealing with Permanent Crisis

The world is grappling with a daunting set of challenges, from high inflation to the climate crisis. Insurers make important contributions to tackling such issues, and robust and conducive policy and regulatory frameworks are key to helping them fulfil this societal role. The Geneva Association’s 2023 Programme on Regulation and Supervision (PROGRES) Seminar brought together representatives from the insurance industry and regulatory, supervisory and wider policymaking communities to explore this interplay in light of the concerns we face today.

Summary

Keynote speech: Approaching the Finishing Line – Preparing for the Implementation of the Insurance Capital Standard

Victoria Saporta, Chair, IAIS Executive Committee and Executive Director, Prudential Regulation Authority & Bank of England

In her keynote speech, Vicky Saporta, Chair of the International Association of Insurance Supervisors (IAIS) Executive Committee and Executive Director, Prudential Regulation Authority at the Bank of England, highlighted the significant progress made in developing the Insurance Capital Standard (ICS).

The year 2023 is a crucial one for the ICS, with several important steps to be carried out, including a comparability exercise between the ICS and the Aggregation Method, collection of stakeholder input on economic impact assessment and consultations on revisions of Insurance Core Principles (ICP) 14 and 17. A mid-year stakeholder session on ICS changes will also take place; those who did not participate were encouraged to share relevant data.

Efforts will shift towards the implementation of the ICS in 2024, but there are also concerns about climate risks and the ability of regulators and policymakers to address global risks amid deglobalisation.

Session 1: Interplay between Health & Insurance Regulation

Adrita Bhattacharya-Craven, Director Health & Ageing, The Geneva Association; Conor Donaldson, CEO, Global Asia Insurance Partnership; Jo-Ann Ferreira, Group Chief Compliance Officer, Discovery; Tom Ground, Managing Director Retirement, Phoenix Group; Andrew Mais, Commissioner, Connecticut Insurance Department and President-Elect, NAIC

With average life expectancy rising globally, the ratio of working years to retirement duration has shifted significantly. This, coupled with poor health behaviors, low financial literacy, increasing constraints on statutory safety nets and more complex living and working patterns, has spurred many life and health insurers to look at consumer needs holistically to bolster physical, financial and social well-being.

Traditional savings, pensions and health plans are integrating well-being services and insurers are adopting a more dynamic approach to evaluating risks – one that incentivises customers through rewards for healthy living, saving and investment habits. In some settings, technological developments have improved access to protection for previously untapped populations and led to the creation of super apps that bundle an ecosystem of services spanning health and financial well-being.

While regulators have welcomed such innovations, issues around affordability persist, particularly for small businesses and the self-insured. Prudential authorities acknowledge a greater need for coordination between financial regulatory objectives and those of health, information and competition authorities as products grow in complexity. However, the bulk of insurance regulation continues to focus primarily on solvency, competition and consumer protection issues.

Insurers have an influential role to play in shaping the way health and financial protection are delivered, but this also calls for enhanced regulatory and policy guidance on the usage of technology-led innovation. Similarly, while there are welcome signs of constructive dialogues, more engagement and transparency are needed to understand how such innovations can mitigate the risks posed by informational asymmetry to insurers while protecting consumer rights and welfare.

Keynote speech: G-7 Preview

Shigeru Ariizumi, Vice Chair, IAIS ExCo and Vice Commissioner for International Affairs, Japanese Financial Services Agency

In his keynote speech, Shigeru Ariizumi, Vice Chair of the IAIS Executive Committee and Vice Commissioner for International Affairs of the Japanese Financial Services Agency, emphasised the need for increased international cooperation during periods of geopolitical tension and economic uncertainty.

Three priority issues for Japan's G7 presidency are tackling immediate global challenges, enhancing global economic resilience and promoting diverse economic policies. Within these overarching priorities, four key themes apply specifically to the financial sector: crypto assets, sustainable reporting and disclosure, transition finance and disaster risk financing.

Crypto assets pose challenges for regulatory and supervisory authorities; stronger anti-money laundering and counter-terrorist financing measures are needed. Sustainability reporting standards being finalised by the International Sustainability Standards Board (ISSB) are a welcome development and should address nature and social issues as well.

A whole-of-economy transition will be required to achieve the goals of the Paris Agreement, and disaster risk financing and protection will be crucial to addressing potential protection gaps.

Session 2: Insurance Capital Standard

Carlos Montalvo, Global Insurance Regulatory Leader, PwC; Gary Anderson, Commissioner, Massachusetts Division of Insurance; Halina von dem Hagen, Global Treasurer & Head of Capital Management, Manulife; Romain Paserot, Deputy Secretary General & Head of Capital and Solvency, IAIS; Shigeru Ariizumi, Vice Chair, IAIS ExCo and Vice Commissioner for International Affairs, Japanese Financial Services Agency; Patricia Plas, Group Director of Public Affairs, AXA

The main hurdles to the effective implementation of the ICS include the lack of a common language for defining success and the high level of preparation needed by stakeholders. Despite these challenges, a risk-based approach that is not overly prescriptive is sensible. Input from the insurance industry in regulatory and supervisory conversations will be key.

The efforts of different jurisdictions to review and reform their regulatory frameworks to make them compatible with the ICS were also explored, stressing different views on issues such as discount rates and disclosure requirements. The risk of ‘double trouble’ – the idea that companies may have to report both local and global standards, which could conflict with each other – was also raised.

Global commitment to reaching an agreement on the ICS is essential. Implementation assessment will play an important role in ensuring consistency across the world.

Session 3: Enabling a Nature-positive Net-Zero Transition – Public policy, regulation and insurance

Maryam Golnaraghi, Director Climate Change & Environment, The Geneva Association; Yoshihiro Kawai, Chair, OECD Insurance & Private Pensions Committee and Global Asia Insurance Partnership; Nick Robins, Professor in Practice for Sustainable Finance, Grantham Research Institute, London School of Economics; Steven Seitz, Director, Federal Insurance Office; Stéphane Tardif, Managing Director, Climate Risk Hub, Office of the Superintendent of Financial Institutions; Bernd Wilke, Senior Risk Manager, Swiss Re

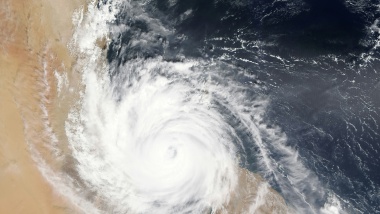

Climate-related disasters are increasing in frequency and severity around the world, which may eventually impact the availability and affordability of insurance in high-risk areas.

Expediting decarbonisation is fundamental to global climate mitigation and adaptation efforts, but huge financing gaps remain. Closing these will require significant contributions from the private sector. On top, a transformation of the financial regulatory system is needed to mobilise and properly allocate the capital needed for the net-zero transition, particularly for developing and emerging economies. Much attention has also been focused on companies’ net-zero targets; prudential supervisors will now play an important role in assessing companies’ plans to actually meet those targets.

Addressing climate change is a top priority for the insurance sector. This will require the industry to stay at the forefront of the public policy debate around the implications of climate-related financial risk.

Moderated interview with Christian Mumenthaler, CEO, Swiss Re

Moderator: Jad Ariss, Managing Director, The Geneva Association; Speaker: Christian Mumenthaler, CEO, Swiss Re; Chairman, The Geneva Association

Re/insurers have helped societies absorb the shocks of recent and ongoing crises, such as the pandemic and effects of climate change. Inflation is expected to persist due to factors like decarbonisation, demographic shifts and changes in global value chains, with mixed effects on insurance balance sheets – life insurers will likely see more positive effects, while P&C insurers may experience initial hits.

It is important for re/insurers to commit to net zero and support the development of emerging climate technologies. Here, the issue is less finance than things like permits for building innovative power plants. Insurers are able to support these innovations by taking on new risks.

The discussion also focused on the hype around AI technologies and the need for targeted regulations, as well as growing cyber risks and geopolitical tensions, which may be stabilised by increased international dialogue.

Session 4: Regulation of Artificial Intelligence in Insurance

Dennis Noordhoek, Director Public Policy & Regulation, The Geneva Association; Birny Birnbaum, Director, Center for Economic Justice; Claudia Donzelmann, Global Head of Regulatory & Public Affairs, Allianz; Bryan Pickel, Head of Government Affairs & Sustainability, Prudential Financial; Sheena Shah, Senior Managing Counsel, Global Multinational, Digital & Climate Practice, Chubb; Kai Zenner, Head of Office & Digital Policy Advisor, MEP Axel Voss

The benefits of AI in insurance include faster and more accurate risk assessments and decisions, more personalised products and services, easier fraud detection and the narrowing of protection gaps. However, it also comes with potential risks, such as biased data sets, discrimination, lack of transparency and human oversight. The panel highlighted the importance of understanding customer concerns and leveraging data for risk mitigation, and agreed that current sectoral regulations should be updated, rather than introducing new AI-specific regulation.

The panel concluded by debating the characteristics of an ideal AI regulatory framework tailored to insurance. Key features of such a framework include data governance, transparency, accountability, and skilled economic analysis. Insurers agreed with several aspects of the framework but expressed concerns about fragmentation and the need to review existing regulations before implementing additional requirements.

Keynote speech: Secular Stagnation and Temporary Stagflation?

Sir Paul Tucker, Research Fellow, Harvard Kennedy School

In his keynote speech, Sir Paul Tucker, Research Fellow, Harvard Kennedy School, discussed the impact of macroeconomics and geopolitics on the insurance industry.

Secular stagnation and real interest rates have important implications for the insurance sector. Low interest rates increase the present value of long-term liabilities while decreasing the running return on assets.

Low interest rates could be attributed to excess savings over investment, or demand for safety and an insufficient supply of safe assets. Increased government borrowing and investment in AI and climate solutions could push global interest rates up, while new technology that lowers the price of investment goods could keep them low. The insurance industry can help raise interest rates by penetrating developing economies and reducing the need for personal savings. Geopolitical anxiety can also impact real interest rates.

Near-term stagflation and the challenges of managing monetary policy amid uncertain inflation expectations present additional challenges. Monitoring U.S. monetary policy will be particularly important in light of upcoming elections.

Session 5: Risk Outlook for the Insurance industry

Edward Mishambi, Chief Risk Officer – Europe, Renaissance Re; Tom Bolt, Executive Vice President & CRO, AIG; Ramón Carrasco Bahamonde, Group CRO, MAPFRE; Jayne Plunkett, Group CRO, AIA Group

In the final panel, Chief Risk Officers (CROs) reflected on their evolving role, considering the multifaceted risks their organisations face. Panellists emphasised the interconnectedness and complexity of risks, including macroeconomics, ESG and geopolitical tensions.

CROs are increasingly expected to act as business partners and so the required skills and expertise is expanding. Scenario analysis and stress testing are crucial tools for assessing the potential impacts of risks on the horizon. Distinctions also need to be made between risks insurers can control and those they cannot. Methodologies need to be developed for both types of risks.

Foresight, collaboration and information sharing will be of particular importance for tackling issues like cyber and climate change. Core competencies for risk teams were also highlighted, such as a sense of urgency, natural curiosity and willingness to speak up. While predicting Black Swan events is difficult, managing unpredictable events when they occur is essential.

Lastly, the panel discussed the role of regulators in addressing risks and fostering public-private partnerships, as well as the need for CEOs to think like CROs in strategy formulation and execution. Overall, the discussion underscored the necessity of a proactive and adaptable approach to risk management in an increasingly volatile environment.