Virtual conference

Transformative Forces in Insurance – The road ahead for insurers and regulators

The COVID-19 pandemic has given rise to or amplified a number of forces that are driving transformation within the insurance industry. This year’s PROGRES Seminar convened insurers, policymakers, regulators and supervisors for discussions on the implications of four of these key issues – post-pandemic risk perceptions, climate change, digitalisation and artificial intelligence (AI), and the low interest rate/high inflation environment – for the regulatory community, insurers and their customers.

Summary

Day 1

Welcome remarks

Jad Ariss, Managing Director of The Geneva Association, welcomed participants to the conference.

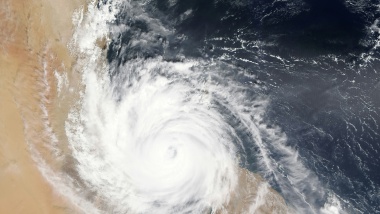

The day of the conference marked one week since the Russian invasion of Ukraine. The war will undoubtedly have implications for the insurance industry. Conflict is playing out physically as well as digitally, and we may see other nations targeted by cyberattacks in response to their economic sanctions on Russia. The geopolitical situation has also swiftly changed the risk landscape for insurers, much as the pandemic did two years ago, giving us cause to once again assess the role insurance can play in protecting people from such extreme risks. The united political and economic reactions of the international community do offer reason for hope, however, especially when we consider other global challenges facing society, such as climate change.

Opening address

Christian Mumenthaler, CEO of Swiss Re and Chairman of The Geneva Association, gave the opening address.

Christian Mumenthaler, CEO of Swiss Re and Chairman of The Geneva Association, set the stage by exploring three of the issues on the conference agenda: the pandemic, climate change and AI.

It is now clear that pandemic risk defies insurability also on the P&C side due to the accumulation of correlated losses. Insurers have revised policy wordings accordingly. Updating pandemic risk models, investing in medical progress and maintaining the infrastructure that has been built to deal with COVID-19 will be key to ensuring we are prepared for future such events. Our common goal must be to enhance resilience by applying the lessons learned from the pandemic.

Meeting net-zero commitments requires insurers to decarbonise their asset and underwriting portfolios, and initiatives such as the cross-sectoral WEF Alliance of CEO Climate Leaders and the Net-Zero Insurance Alliance are providing support. A broader challenge for society is realising the industrial transformation needed to hit zero-carbon targets by 2050. Nature-based solutions and new technologies need to be developed, and insurers can play a role by helping to fund and insure them.

Going forward, digital technology will be embedded across the insurance value chain. However, regulation around AI technologies is not yet there. Changing societal perceptions and tolerance levels make for a highly dynamic landscape. Insurers must therefore exert caution; things that are acceptable today may perhaps not be in a few years. Insurers should participate in this dialogue and work with regulators to define standards now for the benefit of insurance clients.

Keynote speech: Getting Through the Pandemic – Lessons learned for future regulation

Victoria Saporta, Chair of the Executive Committee, International Association of Insurance Supervisors (IAIS).

Regulatory reforms adopted in 2019 proved particularly useful during the pandemic as they allowed for quick risk assessments and responses. COVID-19 also provided a real-life test of the Insurance Capital Standard (ICS), of which the five-year monitoring period remains firmly on track.

Focusing on further global regulatory challenges, the scope of climate risks in the Insurance Core Principles (ICPs) will be made more explicit through a number of changes over the next few years. A series of stakeholder workshops has also been announced to reduce market fragmentation resulting from the emergence of varying practices for climate scenario analysis. Risks emanating from cyber underwriting will be the focus of the Global Insurance Market Report later this year and an issues paper will address the operational risks associated with third-party IT outsourcing. Upcoming work conducted through the FinTech Forum will focus on the fair and ethical adoption of AI and machine learning as well as the use and governance of data. Work in all these areas will be conducted in close consultation and collaboration with the industry.

Panel 1: Risk Perceptions Post-COVID-19 – Insurer and regulator views on emerging trends

(Top) Jonathan Dixon, Secretary General, IAIS; Dieter Hendrickx, Head of Prudential Policy Insurance, National Bank of Belgium. (Bottom) Suzette Vogelsang, Head of Banking, Insurance and FMI Supervision Department, South African Reserve Bank; Martin Hansen, Head of Regulatory Policy, Planning and Strategy, AIG; Hidehiko Sogano, Managing Executive Officer, Dai-ichi Life.

Panellists reflected on key trends including cyber risk, credit risk and interest rate risk. It was pointed out that inflation risk, in combination with low economic growth and low or only gradually moving yields, could cause profitability challenges for insurers. The volatility of global financial markets is an additional challenge for emerging economies. The long-lasting, ultra-low interest rate environment has made it challenging for life insurers in particular to continue offering traditional products.

It was highlighted that although there is a natural symbiosis between macro and microprudential regulatory objectives, they involve the employment of different regulatory tools; microprudential tools are geared towards aligning with and reinforcing and promoting sound, company-specific ERM and capital management, while macroprudential ones are used to scan the horizon, identify common risk factors and herd behaviour. The societal role of insurers will remain important in face of these macrotrends going forward, but there may be a pivot towards products that are less sensitive to interest rates, as well as to new areas such as health. It was made clear that the risks identified in the Global Monitoring Exercise are not revolutionary to insurers and they fit well into existing risk types. When debating the impact of risk-based solvency (RBC) regimes on emerging markets, the panel concluded that it will likely support insurance market development and lead to greater flexibility and innovation, but will also result in more complexity.

Panel 2: The Path to Net Zero – Risks and opportunities for insurers, and the important role for policymakers and regulators

(Top) Ricardo Lara, Insurance Commissioner, California; Maryam Golnaraghi, Director Climate Change and Environment, The Geneva Association; Anna Sweeney, Executive Director, Bank of England. (Bottom) Renaud Guidée, Group Chief Risk Officer, AXA and Chairman, Net-Zero Insurance Alliance; Shelagh Whitley, Chief Sustainability Officer, PRI; Adam Wise, Senior Managing Director, Natural Resources, Manulife.

Incentivising the insurance industry to step up its contribution to achieving net-zero targets will require cross-sectoral collaboration and alignment. Regulators have a key role to play in pushing the adoption of consistent approaches to stress testing and scenario analysis, and reducing capital requirements for green investments would help insurers to step up their game on the investment side. Insurers on the panel pointed out that they are accustomed to managing extreme weather events, but this mainly involves managing the consequences of climate change by providing cover for damage. Managing the risk of extreme climate events is a shared responsibility and will require a wider range of tools. Policymakers and regulators can help to encourage adaptation measures to reduce and prevent physical climate risks through land zoning and the enforcement of building codes, for example. The importance of increased insurance penetration and affordability was also stressed. Panellists further highlighted the need for common metrics to measure carbon footprints, actionable targets to get to net zero and a unified carbon tax. A key remaining challenge for insurers is the ill-defined rules and inconsistencies around disclosure and regulatory expectations. Though a lot of work is being done within the industry, for example through alliances, commitments need to be backed by up by concrete action.

Day 2

Panel 3: Regulating the Use of AI in Insurance – What should the industry expect?

(Top) Lutz Wilhelmy, Director, Swiss Re; Lisa Bechtold, Global Lead Data Governance & Oversight, Zurich Insurance; Sopnendu Mohanty, Chief Fintech Officer, Monetary Authority of Singapore. (Bottom) Kathleen Birrane, Chair NAIC Innovation, Cybersecurity & Technology Committee and Insurance Commissioner of Maryland; Petra Hielkema, Chairperson, EIOPA.

The session started with a discussion on AI use cases in insurance. Although many benefit both insurers and their customers, it is important to beware of unintended consequences, such as discrimination. The panel discussed the specificities of the AI act proposed by the European Commission, a cross-sectoral framework that follows a risk-based approach to classify AI applications as: 1) unacceptable (prohibited – including applications that could cause harm); 2) high risk; 3) low or minimal risk; 4) no risk. There is a proposal to include AI applications used for insurance pricing, underwriting and claims management in the high-risk category. It was said that for most AI use cases in insurance, such classification is inappropriate as these applications do not pose a threat to fundamental human rights. There needs to be a clearly defined rationale for risk classifications. Although the panel agreed that a cross-sectoral approach to AI makes sense for the mitigation of AI-specific risks, it is important that this fits well with other, sectoral regulation and that proportionality is kept in mind. Policymakers need to understand that the insurance industry is data-driven by nature. AI-based decisions in insurance can be reverted and human assessments can still take place after the fact; this needs to be considered when classifying the risk of AI applications in insurance.

Keynote speech: Inflation and re/insurance

Denis Kessler, Chairman, SCOR.

Inflation is reaching multidecade highs in several key economies. Although conditions have been conducive to such an increase for quite some time, it has been accelerated by surges in demand as economies recover from the pandemic and accommodative fiscal and monetary policies remain in place. Disrupted supply chains that are not able to cope with the surge in demand and increases in production costs, caused by labour shortages and rapidly increasing commodity and energy prices (which are being further accelerated by current geopolitical tensions), are only adding to the problem. While central banks believe the increase in inflation is temporary, several factors indicate it will be longer lasting, including high levels of government debt, price/wage spirals, the greening of the economy and fluctuating supply chains. Also important is the raising of interest rates – increases have already been announced by some central banks, with others expected to follow suit.

Although inflation is not necessarily problematic for insurers, an unexpected shift to a high-inflation ‘regime’ is. The balance sheets of insurance business lines are affected very differently. P&C is highly sensitive to inflation as claims are directly indexed on the prices of goods and services; the impact on life insurance is much lower, as these policies often consist of lump sum payments. The severity of the impact of high inflation on insurers ultimately depends on the relationship between inflation and interest rates: 1) inflation accelerates faster than interest rates (most adverse scenario); 2) inflation and interest rates go ‘hand in hand’; 3) interest rates accelerate faster than inflation (best case scenario). We are currently witnessing the first scenario.

Panel 4: Low Interest Rates and High Inflation – The short-term outlook

(Top) Frank Grund, Chief Executive Director, Insurance and Pension Funds Supervision, BaFin; Michael Menhart, Head of Economics, Sustainability and Public Affairs, Munich Re; Denis Kessler, Chairman, SCOR. (Bottom) Ludovic Subran, Chief Economist, Allianz; Natacha Valla, Dean, Sciences Po School of Management and Innovation.

With negative interest rates, inflated balance sheets and potentially lower growth, it is difficult for central banks to increase interest rates. ‘War economics’ coupled with volatile energy and commodity prices make modelling inflation difficult. Panellists expected inflation in Europe to be persistent at between 5% and 9% this year. Considering countries’ and corporates’ high state of indebtedness, high inflation may not necessarily be negative for everyone. Although the insurance sector is robust, the effect of the geopolitical crisis will vary depending on the business line. In life insurance, massive surrenders are unlikely, not least as many policies are unit-linked.

The trigger point for central banks to start raising rates is the biggest open question. They have listened to the markets for too long, making it difficult to act today. However, remaining inactive is not an option as this will negatively affect central banks’ credibility. The panel concluded that, to avoid a combination of low growth and high inflation (‘stagflation’) or even a depression, with lasting negative growth, policy mistakes need to be avoided. The longer central banks wait, the steeper the interest rate increase will need to be. To positively impact insurers, at least 100 basis points are needed in Europe and 250 in the U.S. Even this, however, will not lead to a return of products with high guaranteed yields.